Let’s be real—how many times have we marked a support area thinking, “I’ll go long here,” only to watch the price reverse before your zone and take off without you? Feels unfair, right?

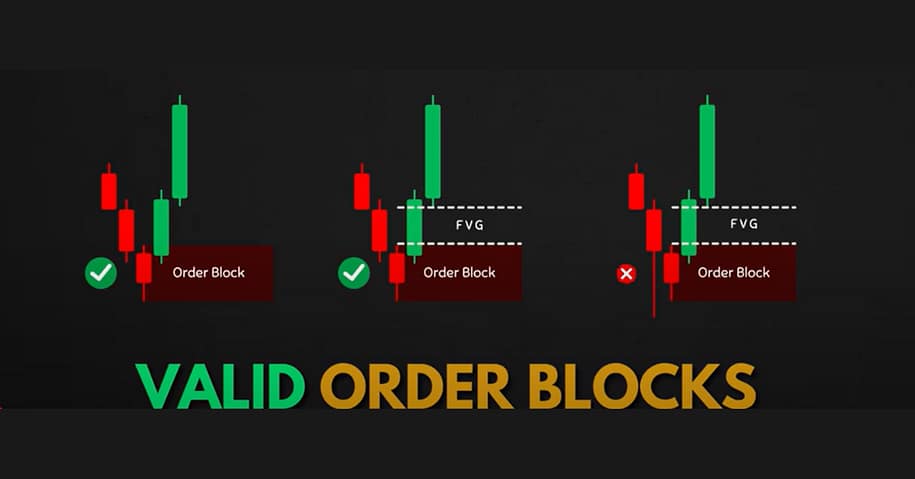

That’s where Order Blocks come in. Here, we learn about how to trade an order block in trading. Whenever someone want to trade an order block in trading, it is most important to remember some rules and avoid common mistakes which are discussed below.

Order blocks are zones where smart money—aka big institutional players—execute their trades. These zones aren’t just random; they’re calculated areas where pending orders often remain, giving us a unique trading edge.

Product Highlight

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Nunc imperdiet rhoncus arcu non aliquet. Sed tempor mauris a purus porttitor

Learn more