Imagine you are sailing a boat across the ocean. To stay on track, you keep an eye on the horizon and follow a straight path to reach your destination. Similarly, trendlines are like straight lines in the trading world, guiding traders to where the market might go next.

Trendline trading is a method that many traders use to identify and follow market direction. This helps traders understand whether prices will continue to rise, fall, or remain stable, allowing them to make more informed decisions.

In this post, you will learn everything you need to know about trendline trading. Whether you’re new to trading or have some experience, by the end of this post, you’ll understand how to draw trendlines, use them to spot trading opportunities and avoid common mistakes.

We will break down the process into simple steps, making it easy for you to use trendlines in your trading strategy.

Trendlines are simply lines that you draw on a price chart to connect important points such as the lowest and highest prices for a specific period. These lines show the direction in which prices are moving up, down, or sideways. By drawing and analyzing trendlines, traders can predict where prices may go next.

For example, if the trendline shows that prices are steadily rising, traders may decide to buy in anticipation that prices will continue to rise. On the other hand, if prices are falling, the trader may decide to sell to avoid losses. But for this buying and selling there is a need to follow certain rules, look at market conditions, hurdles before target, risk reward ratio. You cant make decision only relied on trendline because many times trapping happens on trendline so traders have to more alert while take trade on trendline. They have to define some rules based on back testing / live market observation and follow them strictly.

A trendline is a basic but powerful tool in technical analysis, which studies past market data to predict future price movements.

Table of Contents

ToggleWhat is Trendline Trading?

Trendline trading is a technique used by traders to make decisions about buying or selling assets such as stocks, currencies, or commodities. It involves drawing a straight line on a price chart to represent the general direction in which the price is moving. These lines, known as trendlines, help traders visualize market trends.

By following these trends, traders can predict future price movements and make informed decisions. Trendline trading is a fundamental part of technical analysis, which is the practice of analyzing past market data such as price and volume to predict future movements.

There are two main types of trendlines that traders use:

1. Uptrend Line: Connecting a high to a low in an uptrend

What is an uptrend line? An uptrend line is drawn by connecting the lowest points (called lows) on a price chart, where each low is higher than the previous one. This line curves upward, indicating that the price generally moves higher over time.

Why it matters: When the price touches the uptrend line and then backs up, it indicates that the trend is still strong and the price may rise. Traders usually look for buying opportunities when the price is near the uptrend line, expecting the uptrend to continue.

2. Downtrend Line: Connecting the lower high in the downtrend

What is a downtrend line? A downtrend line is drawn by connecting the highest points (called highs) on a price chart, where each high is lower than the previous one. The line slopes downward, indicating that the price generally decreases over time.

Why it matters: When the price touches the downtrend line and then falls again, it indicates that the downtrend is still there and the price may continue to decline. Traders often look for selling opportunities when the price is near the downtrend line, expecting the downtrend to continue.

Trendlines are important because they provide a clear and easy way to identify market direction. Here’s why traders rely on trendlines:

Identifying trends: Trendlines help traders see the market’s overall direction – whether prices are rising, falling, or moving sideways. This is important because trading in the direction of the trend is usually safer and more profitable than going against it.

Finding Entry Points: When a trader sees that the price is approaching the uptrend line, they may decide to buy, the price will bounce off the line and continue to rise. Similarly, if the price is near the downtrend line, a trader may choose to sell in anticipation of the price falling further.

Determining Exit Points: Trendlines help traders decide when to exit a trade. If the price breaks out of the trendline falls below the uptrend line or goes above the downtrend line this can signal that the trend is changing, prompting the trader to close out their position to limit profits or losses.

Trendlines are a simple yet powerful tool used to spot trends, identify potential trading opportunities, and make decisions to enter or exit a trade. By understanding and using trendlines, traders can better navigate the market and improve their chances of success.

How to Draw Trendlines?

Tools Required: List the tools or platforms that can be used to draw trendlines

To draw trendlines, you don’t need any special tools—just a price chart and a platform that lets you draw on it. Here are some common tools and platforms you can use:

- Trading Platforms: Many online trading platforms, like MetaTrader, ThinkorSwim, or NinjaTrader, have built-in tools for drawing trendlines.

- Charting Websites: Websites like TradingView or StockCharts offer interactive charts where you can easily draw trendlines.

- Mobile Apps: There are various trading and charting apps available for smartphones, like Investing.com or the TradingView app, that allow you to draw trendlines on the go.

These tools are user-friendly, and you can start drawing trendlines with just a few clicks or taps.

Step-by-Step Guide

Here’s a simple guide to drawing trendlines:

1. Identify the Trend (Uptrend, Downtrend, or Sideways Trend)

Look at the Price Chart: Start by looking at the price chart of the asset you’re interested in. Notice how the price has been moving over time.

Uptrend: If the price is generally moving higher, forming a series of higher lows (each low is higher than the last one), then you’re in an uptrend.

Downtrend: If the price is generally moving lower, forming a series of lower highs (each high is lower than the last one), then you’re in a downtrend.

Sideways Trend: If the price is moving within a narrow range, without a clear upward or downward direction, it’s in a sideways trend.

2. Connect Minimum Three or More Significant Points (Lows for an Uptrend, Highs for a Downtrend)

Uptrend Line: In an uptrend, find three or more significant lows on the chart (points where the price has dipped but then moved higher). Use these points to draw a straight line connecting them. This line will slope upwards.

Downtrend Line: In a downtrend, find three or more significant highs on the chart (points where the price has risen but then moved lower). Use these points to draw a straight line connecting them. This line will slope downwards.

Sideways Trend: If the market is moving sideways, you might connect the highs and lows within that range, but in trendline trading, sideways trends are less useful for predicting future price movements.

3. Extend the Line into the Future to Predict Potential Support/Resistance

Extend the Trendline: Once you’ve drawn the line connecting the significant points, extend it into the future. This extended line can act as a guide, showing you potential areas where the price might find support (for an uptrend) or resistance (for a downtrend).

Use the Line to Make Predictions: If the price approaches your trendline in the future, it might bounce off the line, suggesting the trend is likely to continue. Alternatively, if the price breaks through the line, it could indicate that the trend is changing direction.

Common Mistakes to Avoid: The pitfalls like forcing trendlines where they don’t naturally fit

When drawing trendlines, it’s important to avoid some common mistakes:

1. Forcing Trendlines Where They Don’t Fit

Don’t Force a Line: Sometimes, traders try too hard to make a trendline fit the data, even when the market doesn’t show a clear trend. If the price points don’t naturally align, it’s better to leave the trendline out than to force it. A forced trendline can give you misleading information, leading to poor trading decisions.

2. Using Too Few Points

More Points for More Accuracy: The more points (highs or lows) you connect with your trendline, the more reliable it is. A trendline based on just two points might not be very strong, and the market might not respect it. Look for at least three points to draw a more reliable trendline.

3. Ignoring Long-term Trends

Consider the Bigger Picture: Sometimes, traders focus too much on short-term price movements and draw trendlines based on a very limited time frame. It’s important to consider the longer-term trend as well, as this gives you a better understanding of the overall market direction.

4. Relying Solely on Trendlines

Don’t Use Trendlines Alone: While trendlines are helpful, they shouldn’t be the only tool you use. It’s important to combine them with other indicators and analysis techniques to make more informed trading decisions.

Drawing trendlines is a simple yet powerful way to visualize market trends and predict future price movements. By following these steps and avoiding common mistakes, you can improve your trading strategy and make more confident decisions.

Types of Trendlines

Trendlines can be simple or complex, depending on how they are drawn and used. Let’s break down the different types of trendlines in simple terms:

A Simple Trendline

1. Uptrend lines

What they are: Uptrend lines are drawn when the price is moving higher over time. You connect the lowest point (bottom) on the chart where the price went down but then went up again. This line is upward-sloping.

How they work: An uptrend line indicates that the market is generally rising. Traders use predictions that prices will rise. If the price touches the uptrend line and then moves back up, it is a sign that the trend is still strong.

2. Downtrend lines

What they are: Downtrend lines are drawn when the price decreases over time. You connect the highest point (high) on the chart where the price rose but then moved back down. This line descends downwards.

How they work: A downtrend line indicates that the market is generally falling. Traders use it to predict that prices will decrease. If the price touches the downtrend line and then falls again, it indicates that the downtrend is still there.

Complex Trendlines

1. Channel

What they are: Channels are created by drawing two parallel lines with price movement between them. One line acts as an uptrend or downtrend line and another is drawn parallel to it, with price action between these two lines.

How they work: Channels give traders a clear view of the range in which price is moving. If the price reaches the top of the channel, it may fall again. If it hits the bottom, it can bounce back up. A range of traders use channels to identify both buying and selling opportunities.

2. Internal trendline

What they are: Internal trendlines are not drawn strictly by connecting highs or lows. Instead, they are drawn through price action to identify trends within larger trends. They can indicate minor trends in the main movement of the market.

How they work: Internal trendlines help traders spot small, internal trends that may not be obvious. For example, in a large uptrend, there may be a temporary downtrend, and an internal trendline can help you see this. These lines are useful for more experienced traders who want to better their analysis.

3. Dynamic trendline

What they are: Dynamic trendlines move with price, based on more advanced calculations like Fibonacci retracement levels. Unlike simple trendlines, which are static, dynamic trendlines can change as new data arrives.

How they work: Dynamic trendlines are used by traders who want to incorporate more sophisticated analysis into their trading.

For example, a Fibonacci retracement can show where the price could potentially reverse, and the dynamic trendline will move to reflect this. These trendlines are more flexible and can provide more accurate predictions in certain situations.

Understanding different types of trendlines allows traders to analyze the market in different ways.

Simple trendlines give you a basic understanding of market direction, while complex trendlines such as channels, internal trendlines, and dynamic trendlines provide more detailed insights and can be useful for various trading strategies.

By knowing how to use these trendlines, you can better predict price movements and make more informed trading decisions.

Using Trendlines in Trading Strategies

Trendlines aren’t just lines on a chart—they’re powerful tools that traders use to make decisions about when to buy or sell. Let’s see how you can use trendlines in different trading strategies:

Breakout Trading

1. How to identify breakouts using trendlines

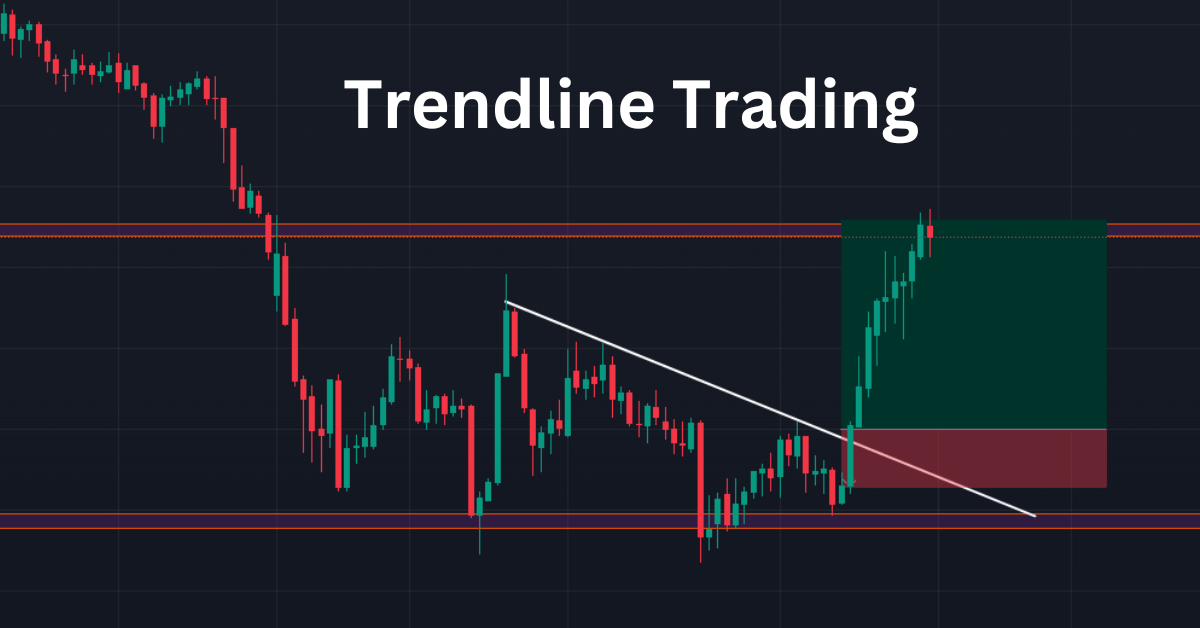

What is a breakout? A breakout occurs when the price moves beyond the trendline, either below the uptrend line or above the downtrend line. It can signal a major change in the market, such as the start of a new trend or the end of a current one. Before break out or break down there is requirement of three points connection and strong support resistance level price may come from there. Trendlines created by chart in this market conditions are more reliable and they have good win rate.

Identifying breakouts: To detect breakouts, look at how the price behaves as it approaches the trendline. If the price crosses the trendline and continues in that direction with strong momentum (that is, it moves quickly and decisively), then this is likely to be a breakout. Candle closing with breakout is most important. With out candle closing do not consider it break out or break down.

2. Examples of entry and exit policies

Entry Strategy: If you spot a breakout above the uptrend line, you can decide to buy and enter the trade, expecting the price to continue rising. Similarly, if the price breaks below the downtrend line, you can place a sell or short (bet against the price) in the expectation that it will continue to decline.

Exit Strategy: After entering a trade based on a breakout, you can use the previous trendline as a reference to set a stop loss order. A stop-loss order automatically closes your trade if the price goes against you, limiting your losses.

For example, if you bought after an upward breakout, you can place a stop-loss just below the old uptrend line to protect yourself if the breakout fails and the price pulls back.

Trendline Bounce

1. Using trendlines as support and resistance

What is Bounce? A bounce occurs when the price touches the trendline and then reverses direction, moving away from the line. In an uptrend, the trendline acts as support, meaning it pushes the price up. In a downtrend, the trendline acts as resistance, i.e. prevents the price from rising.

Identifying Bounces: See how the price reacts when it approaches a trendline. If the price approaches the trendline and then starts moving in the opposite direction, it is likely to break out of the trendline.

2. Strategies to capitalize on price bounces from trendlines

Entry Strategy: In an uptrend, if the price breaks out of the trendline (i.e. it touches the line and then starts to rise again), it may be a good time to buy.

In a downtrend, if the price breaks out of the trendline (touches the line and then starts falling again), it may be a good time to sell.

Exit Strategy: You can set a target price where you plan to exit the trade if the price continues towards the bounce. Alternatively, you can exit if the price breaks out of the trendline, indicating that the trend is reversing.

Combining trendlines with other indicators

1. Examples include Moving Average, RSI, MACD

Moving Averages: Moving averages smooth price data to help you see trends more clearly. If both the trendline and the moving average indicate the same trend (both pointing upwards or downwards), it strengthens the case for moving ahead of that trend.

RSI (Relative Strength Index): RSI measures how quickly the price has moved recently to determine whether an asset is overbought (too high) or oversold (too low). If the RSI shows that the asset is oversold near the trendline in an uptrend, it could be a good buying opportunity.

Conversely, if the RSI shows that the asset is overbought near the trendline in a downtrend, it may be a good selling opportunity.

MACD (Moving Average Convergence Divergence): MACD is another indicator that shows the relationship between two moving averages of price. If the MACD shows a change in momentum when the price is close to the trendline, it may indicate a good time to enter or exit the trade.

2. How combining these can increase the accuracy of your transactions

Why combine indicators? Although trendlines are powerful, they are not foolproof. By combining trendlines with other indicators such as moving averages, RSI, or MACD, you can get a more complete picture of what the market might do next. This combination can help you confirm trends, identify strong entry and exit points, and reduce the chance of making a mistake.

Example of Composite Indicators: Let’s say you see an uptrend with price outside the trendline. If the RSI is also showing that the asset is not overbought and the MACD is showing upward momentum, this combination of signals can give you more confidence to buy. Likewise, if the price is near the downtrend line and both the RSI and MACD indicate weakness, you may feel safer selling.

Trendlines are an important tool in trading, but they become more powerful when used in conjunction with other strategies and indicators. Whether you’re looking for breakouts, bounces, or combinations of signals, mastering how to use trendlines can significantly enhance your trading success.

You may like to read also: How to Draw Support and Resistance Levels on All-Time High Market

Advantages and Limitations of Trendline Trading

Trendline trading is a popular method among traders for its simplicity and effectiveness, but like any tool, it has its pros and cons. Let’s break it down:

Advantages

1. Simplicity and ease of use

Why it’s easy: Drawing a trendline is straightforward. You don’t need any complicated formulas or software—just a price chart and your eyes. Even beginners can quickly learn how to identify and draw trendlines to spot market trends.

Ease of Use: Once you know how to draw a trendline, you can easily apply it to a variety of assets such as stocks, forex, or commodities. This makes trendline trading an accessible technique for traders of all experience levels.

2. Helps visualize market trends

A clear picture of the trend: Trendlines give you a visual representation of the direction of the market. Whether prices are moving up, down, or sideways, a trendline helps you see the overall trend at a glance.

Decision-Making Tool: Using trendlines, you can quickly identify potential buying or selling opportunities. For example, if a price is consistently bouncing above the uptrend line, it indicates that the uptrend is strong, giving you the confidence to trade.

3. Can be used in combination with other technical tools

Increases accuracy: Trendlines can be combined with other technical analysis tools such as moving averages, RSI, or MACD. This combination strengthens your trading strategy by confirming trends and reducing the risk of false signals.

A flexible tool: Whether you’re using basic indicators or more advanced ones, trendlines can fit into almost any trading strategy, making them versatile and useful in a variety of market conditions.

Limitation

1. Subjectivity in trendline drawing

Why it’s subjective: Different traders can draw trendlines differently based on how they interpret the market. For example, one trader may connect some lows while another may choose a different point, leading to different conclusions about the trend.

Inconsistent results: Because of this subjectivity, trendlines can sometimes be less reliable. What one trader sees as a strong trendline may not be seen the same way by another trader, leading to inconsistent trading decisions.

2. Can give false signals in choppy markets

Choppy Markets: In markets where prices move erratically without a clear direction, trendlines can provide misleading signals. The price may cross the trendline several times, making it difficult to distinguish between a real breakout and a fake one.

Risk of Mistakes: In such a situation, relying only on trendlines may lead to buying or selling at the wrong time, resulting in losses. This is why it is important to use trendlines along with other indicators, especially in volatile markets.

3. Not foolproof; Confirmation from other indicators is required

Why it’s not foolproof: While trendlines are useful, they don’t always accurately predict future price movements. Markets can be unpredictable and trendlines may not always hold.

Need for Confirmation: To reduce the risk of relying only on trendlines, it is important to confirm signals with other indicators. For example, if a trendline suggests a buying opportunity, you can check if the RSI or MACD supports that signal before trading.

Advantages of trendline trading include its simplicity, ability to visualize market trends, and flexibility in combining with other tools. However, it also has limitations such as subjectivity in drawing trendlines, the potential for false signals in choppy markets, and the need for confirmation from other indicators.

Understanding both the strengths and weaknesses of trendline trading can help you use it more effectively and avoid common pitfalls.

Common Mistakes to Avoid in Trendline Trading

Trendline trading can be a powerful strategy, but it’s easy to make mistakes if you’re not careful. Here are some common mistakes to watch out for and how to avoid them:

1. Overfitting trendlines

What is overfitting? Overfitting occurs when you try too hard to match a trendline to price data, even if it doesn’t fit. For example, because you want the trendline to appear valid, you can force the line to connect points that do not form a clear trend.

Why this is a problem: When you overfit a trendline, it loses its reliability. Trendlines that are not naturally aligned with market movements are more likely to give you wrong signals, leading to poor trading decisions. You may think the trend is stronger than it is, or you may miss signs that the trend is weakening.

How to avoid this: Only draw trendlines where there is a clear, natural alignment of highs or lows. Don’t force a line where it doesn’t belong. If the market does not show a clear trend, it is better to wait for a better opportunity than to try to fit the trendline.

2. Ignoring confirmation

What is Ignore Confirmation? Confirmation is ignored when you rely solely on trendlines to make trading decisions without checking other indicators or tools for additional confirmation. For example, you might see a price bounce off a trendline and decide to trade based on that alone without considering other factors such as market momentum or volume.

Why it’s a problem: Trendlines can be powerful, but they’re not always accurate on their own. Markets can be unpredictable and sometimes trendlines give wrong signals. Without confirmation from other tools, you may enter transactions that may not be profitable.

How to avoid it: Always use trendlines in combination with other technical analysis tools. For example, if you see price bouncing on a trendline, check if other indicators such as RSI (Relative Strength Index) or MACD (Moving Average Convergence Divergence) also indicate that the market is likely to move in the same direction. This additional confirmation can help you make more confident and accurate trading decisions.

3. Chasing the trend

What is a chasing trend? Trend chasing means jumping into a trade because a trend appears to be forming without proper analysis. This often happens when traders fear losing potential profits and rush into trades without fully understanding the situation.

Why this is a problem: When you follow a trend, you may enter the trade too late just as the trend is reversing.

Hence, a sudden change in direction by the market can lead to losses. Additionally, following trends means you are making decisions based on emotion rather than logic and analysis, which can lead to poor results.

How to avoid it: Before entering any trade, take the time to thoroughly analyze the situation. Look at trendlines, but consider other factors such as market conditions, news events, and additional indicators. Make sure the trend is strong and supported by other data. Better to miss an opportunity than rush into a bad trade.

Avoiding common mistakes in trendline trading can help you make better decisions and improve your chances of success. Overfitting trendlines can lead to unreliable signals, so it’s important to draw lines that naturally fit the market’s movements.

Ignoring confirmation can leave you vulnerable to false signals, so always use other indicators to back up what your trendlines are telling you.

Finally, chasing trends without proper analysis can lead to poor timing and emotional decisions, so take the time to fully evaluate each trade before jumping in. By keeping these pitfalls in mind, you can use trendline trading more effectively and with more confidence.

Conclusion

Trendline trading takes practice and patience to master. It is important to remember that while trendlines are a powerful tool, they are not foolproof. To be a successful trendline trader, keep these final pieces of advice in mind:

The more you practice, the better you’ll get at identifying natural trendlines. Take your time to learn how to remove them correctly and avoid forcing them where they don’t fit.

Don’t rely solely on trendlines. Combine them with other technical indicators to confirm trends and make more confident trading decisions.

Don’t rush into a trade just because you see a trend forming. Take the time to thoroughly analyze the market and wait for the right opportunities. Patience and discipline are the keys to long-term success in trading.

By understanding the basics, avoiding common pitfalls, and constantly improving your skills, you can make trendline trading a valuable part of your trading strategy. Remember, like any skill, mastery comes with time and consistent effort.