Support and resistance levels are critical concepts in options trading, serving as key markers on price charts that help traders understand market dynamics.

Support levels represent price levels where an asset has historically found buying interest, preventing it from falling further. Think of support as a floor that keeps the price from dropping lower. When the price approaches a support level, there tends to be increased demand for the asset, causing buyers to step in and support the price.

On the other hand, resistance levels are price levels where an asset has historically encountered selling pressure, preventing it from rising further. Resistance acts like a ceiling that prevents the price from moving higher. When the price approaches a resistance level, there tends to be an increased supply of the asset, causing sellers to step in and resist further price increases.

The significance of support and resistance levels lies in their ability to provide valuable insights into market sentiment and price action. Traders closely monitor these levels to gauge the strength of buying and selling forces in the market.

Support and resistance levels help traders identify optimal entry and exit points for their options trades. When the price approaches a support level, traders might consider buying options or entering bullish positions, anticipating a potential price bounce. Conversely, when the price nears a resistance level, traders might consider selling options or entering bearish positions, anticipating a potential price reversal.

Understanding support and resistance levels is essential for effective risk management. By placing stop-loss orders or setting profit targets near these levels, traders can mitigate risk and protect their capital. Support and resistance levels serve as reference points for defining risk-reward ratios and determining the validity of trading setups.

Successful options trading often involves crafting strategies that capitalize on market inefficiencies and price patterns. Support and resistance levels play a crucial role in shaping these strategies. Traders can develop bounce trading strategies, breakout trading strategies, or trend reversal strategies based on how price interacts with these levels.

In this blog post, we understand the role of support and resistance levels to empower options traders to make informed decisions, manage risk effectively, and execute profitable trading strategies in dynamic financial markets.

Understanding Support Resistance Levels

Explanation of Support Levels:

1. Definition and Characteristics:

Support levels in trading are like sturdy floors under a bouncing ball. They represent price points where the demand for an asset is strong enough to stop its price from falling further. Think of it as a level where buyers are willing to step in and purchase the asset, preventing it from dropping lower. When the price reaches a support level, it tends to bounce back up.

2. How Support Levels are Formed:

Support levels are formed due to various reasons. They could be psychological levels where traders believe the price is cheap and worth buying. They could also be based on fundamental factors like earnings reports or economic data that attract buyers. Additionally, technical factors such as moving averages or trendlines can also act as support levels.

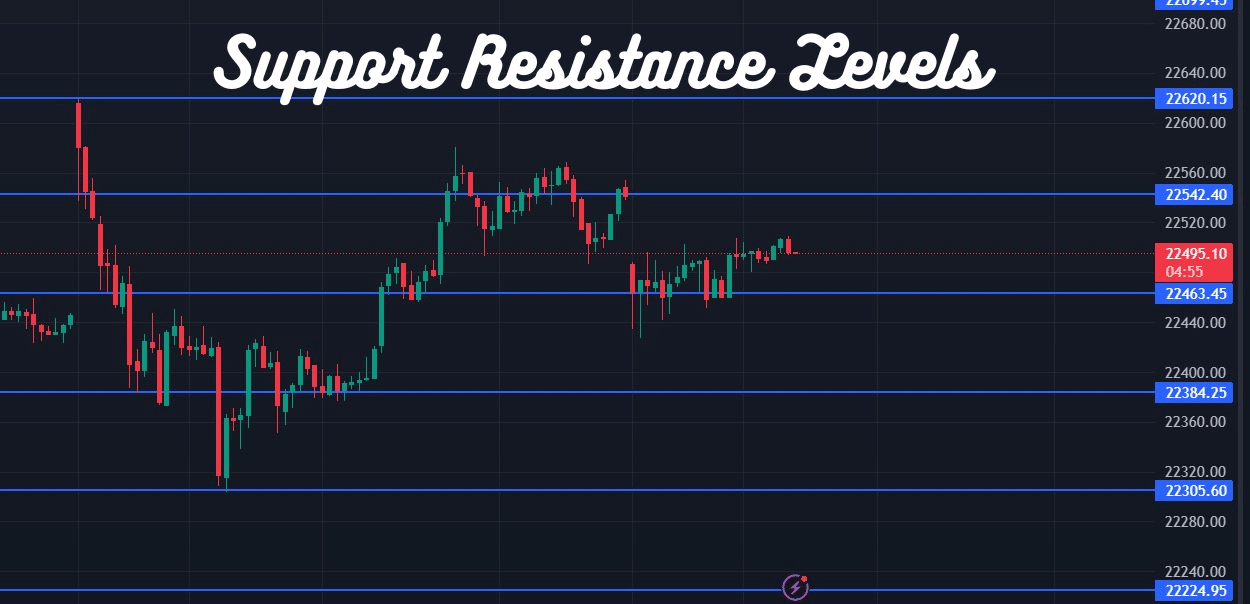

3. Identifying Support Levels on Price Charts:

Traders identify support levels by looking at price charts. Support levels are typically seen as horizontal lines where the price has bounced multiple times in the past. These lines indicate areas where buying interest has historically been strong. Common tools for identifying support levels include drawing trendlines connecting the lows of price movements or using indicators like the Relative Strength Index (RSI) to confirm support levels.

Explanation of Resistance Levels:

1. Definition and Characteristics:

Resistance levels are like strong ceilings above a rising balloon. They represent price points where the supply of an asset is strong enough to prevent its price from rising further. Resistance levels act as barriers where sellers are willing to sell the asset, preventing it from moving higher. When the price reaches a resistance level, it tends to reverse direction and move downwards.

2. How Resistance Levels are Formed:

Resistance levels are formed for various reasons. They could be psychological levels where traders believe the price is expensive and worth selling. They could also be based on fundamental factors like company announcements or economic events that create selling pressure. Additionally, technical factors such as previous highs or Fibonacci retracement levels can also act as resistance levels.

3. Identifying Resistance Levels on Price Charts:

Similar to support levels, traders identify resistance levels by analyzing price charts. Resistance levels are often seen as horizontal lines where the price has struggled to break above multiple times in the past. These lines indicate areas where selling pressure has historically been strong. Traders can use similar tools and indicators as with support levels to identify and confirm resistance levels.