In options trading, the risk-reward ratio is a fundamental concept that assesses the potential gain versus the potential loss of a trade. It quantifies the relationship between the amount of risk taken on a trade (potential loss) and the potential reward (profit) that the trade could generate.

Essentially, the risk-reward ratio helps traders evaluate whether a trade is worth taking based on the potential return relative to the amount of risk involved.

Managing risk and reward is crucial for achieving success in options trading. By understanding and effectively applying the concept of risk-reward ratio, traders can make informed decisions that align with their risk tolerance and trading goals.

Proper risk management not only helps protect capital during unfavorable market conditions but also maximizes the potential for consistent returns over the long term.

In this blog post, readers will gain an overall understanding of risk-reward ratios in options trading. We’ll start by defining what the risk-reward ratio entails and why traders need to grasp this concept.

Table of Contents

ToggleWhat is the Risk Reward Ratio?

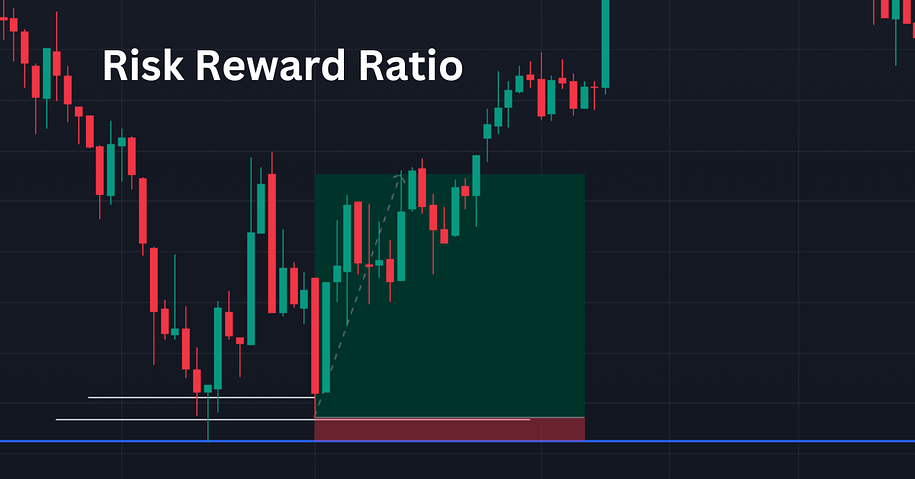

The risk-reward ratio is a fundamental concept in options trading that measures the potential reward of a trade against the amount of risk taken.

It helps traders assess whether a trade is worth pursuing based on the potential profit relative to the potential loss. For example, if a trade offers a higher potential reward compared to its potential risk, it may be considered more favorable in terms of the risk-reward ratio.

Options traders use the risk-reward ratio to evaluate the profitability and risk level of their trades before entering into them. By understanding this ratio, traders can make informed decisions and manage their trades more effectively.

Basic Formula for Calculating Risk-Reward Ratio:

The risk-reward ratio can be calculated using a simple formula:

Risk-Reward Ratio = Potential Reward/Potential Risk

Here, the potential reward is the expected profit from the trade, and the potential risk is the potential loss if the trade does not go as expected. For example, if a trader expects to make Rs. 200 on a trade while risking a potential loss of Rs. 100, the risk-reward ratio would be:

Risk-Reward Ratio = 200/100 = 2

A risk-reward ratio of 2 indicates that for every rupee risked, the trader expects to gain Rs. 2 in return if the trade is successful. Its also known as one as to two risk reward ratio and denote as 1:2.

Importance of Risk Management:

Risk management is vital for preserving capital and achieving consistent returns in options trading.

By effectively managing risk, traders can protect their investments from significant losses during adverse market conditions. Risk management strategies, including appropriate risk-reward ratios, help traders stay disciplined and avoid emotional decision-making.

Risk-reward ratios play a crucial role in risk management by guiding traders to make rational decisions based on potential rewards relative to risks.

A favorable risk-reward ratio ensures that potential profits justify the level of risk taken, thereby increasing the probability of overall trading success.

Traders who prioritize risk management are better positioned to navigate market uncertainties and maintain long-term profitability in options trading.

Optimal Risk-Reward Ratios for Different Strategies

The optimal risk-reward ratio can vary depending on the specific options trading strategy being employed. Let’s explore the ideal risk-reward ratios for three common strategies: covered calls, straddles, and vertical spreads.

Covered Calls:

A covered call strategy involves selling a call option against a stock that the trader already owns. The risk in this strategy is limited to the potential downside of owning the stock, while the reward is limited to the premium received from selling the call option.

Typically, the risk-reward ratio for covered calls is relatively low, often around 1:1 to 1:3. This means that the potential reward (premium received) is lower than the potential risk (the downside of holding the stock), reflecting a conservative income-generating strategy.

Straddles:

A straddle strategy involves buying both a call option and a put option with the same strike price and expiration date. This strategy profits from significant price movements in either direction.

The risk-reward ratio for straddles can vary widely depending on market volatility and the cost of purchasing both options.

In high-volatility environments, straddles may have a higher risk-reward ratio (e.g., 1:5 or more) due to the potential for large price swings.

Vertical Spreads:

Vertical spreads, such as bull spreads or bear spreads, involve simultaneously buying and selling options of the same type (calls or puts) but with different strike prices. These spreads limit both risk and reward compared to outright options positions.

The risk-reward ratio for vertical spreads is typically moderate, ranging from 1:1 to 1:2. The ratio depends on the width of the spread and the potential price movement of the underlying asset.

Market Conditions and Strategy Complexity:

The optimal risk-reward ratios for different strategies can be influenced by prevailing market conditions and the complexity of the strategy itself. In volatile markets, traders may seek strategies with higher risk-reward ratios to capitalize on price fluctuations. However, higher potential rewards often come with increased risk.

Strategy complexity also plays a role in determining risk-reward ratios. More complex strategies, such as iron condors or butterfly spreads, may offer unique risk-reward profiles that require careful evaluation. As strategies become more intricate, traders should consider not only the potential rewards but also the associated risks and probability of success.

Calculating Risk-Reward Ratio in Options Trading

Calculating the risk-reward ratio is essential for assessing the potential profitability of options trades. Let’s break down the calculation process step-by-step and understand the components involved:

1. Define Risk (Maximum Loss) and Reward (Maximum Gain) in an Options Trade:

Risk (Maximum Loss):

This refers to the potential amount that could be lost if the options trade does not perform as expected. In options trading, the risk is typically limited to the premium paid for purchasing the options contract. For example, if you buy a call option for Rs. 200, the maximum risk is Rs. 200, which is the premium paid.

Reward (Maximum Gain):

This represents the potential profit that can be earned from the options trade if it reaches the desired outcome. The maximum gain is theoretically unlimited for certain options strategies like buying call options (in a rising market) or selling put options (in a stable or rising market).

2. Calculating the Risk-Reward Ratio Using the Formula:

The risk-reward ratio is calculated by dividing the potential profit by the potential loss. The formula is as follows:

Risk-Reward Ratio = Potential Profit/Potential Loss

Here’s how to calculate the risk-reward ratio step-by-step:

Example:

Let’s say you’re considering buying a call option on a stock trading at Rs.50 per share. You believe the stock price will rise, so you buy a call option with a strike price of Rs. 55 for a premium of Rs.200 (total cost of the option).

Potential Loss (Risk):

The maximum loss is limited to the premium paid for the call option, which is Rs. 200.

Potential Profit (Reward):

The potential profit depends on how much the stock price rises above the strike price. Let’s assume the stock price reaches Rs. 65 by expiration. The profit from exercising the call option would be calculated as follows:

Option payoff = Stock price at expiration – Strike price

Option payoff = Rs. 65 – Rs. 55 = Rs. 10 per share

Total profit = Option payoff per share × Number of shares (1 contract = 100 shares)

Total profit = Rs. 10 × 100 = Rs. 1,000

Subtract the initial premium paid: Rs. 1,000 – Rs. 200 = Rs. 800 (Potential Profit)

3. Calculating the Risk-Reward Ratio:

Now, use the calculated potential profit and potential loss to determine the risk-reward ratio:

Risk-Reward Ratio = Potential Profit/Potential Loss

Risk-Reward Ratio = 800/200

Risk-Reward Ratio = 4

In this example, the risk-reward ratio is 1:4, which means for every Rs. 1 risked (premium paid), the potential profit is Rs. 4 if the trade is successful.

Understanding and calculating the risk-reward ratio before entering options trades is essential for making informed decisions and managing risk effectively. Traders should evaluate risk-reward ratios alongside other factors such as market conditions, volatility, and personal risk tolerance to optimize their options trading strategies.

Managing Risk with Position Sizing

Position sizing is a critical aspect of risk management in options trading that involves determining the appropriate amount of capital to allocate to each trade. Proper position sizing is essential for maintaining favorable risk-reward ratios and ensuring consistent profitability over time.

Importance of Position Sizing:

Effective position sizing helps traders control the amount of risk exposure in their portfolios.

By allocating the right proportion of capital to each trade, traders can limit potential losses while maximizing potential returns. This approach reduces the impact of individual trade outcomes on overall portfolio performance, promoting long-term sustainability and risk control.

Adjusting Position Sizes Based on Risk Tolerance and Trade Setup:

Position sizes should be adjusted based on a trader’s risk tolerance and the specific characteristics of each trade setup. Traders with lower risk tolerance may choose smaller position sizes to minimize potential losses, while those comfortable with higher risk may allocate larger portions of their capital to high-probability trades.

When determining position sizes, traders should consider factors such as:

Account Size:

The total capital available for trading influences the maximum position size a trader can take without overexposing their portfolio.

Stop-Loss Levels:

Setting appropriate stop-loss levels based on technical analysis or risk management rules helps determine the potential loss per trade, which in turn influences position sizing.

Trade Confidence:

Trades with higher confidence levels and favorable risk-reward ratios may warrant larger position sizes compared to speculative or uncertain trades.

Adjusting position sizes based on risk tolerance and trade setup allows traders to optimize risk management and align their trading strategies with their overall financial goals.

Factors Affecting Risk-Reward Ratios

Several key factors impact risk-reward ratios in options trading:

1. Implied Volatility:

Implied volatility reflects the market’s expectation of future price fluctuations. Higher implied volatility increases option premiums, affecting both potential rewards and risks. Traders may adjust risk-reward ratios based on prevailing implied volatility levels to capitalize on pricing opportunities.

2. Time Decay (Theta):

Time decay refers to the erosion of an option’s value as it approaches expiration. Options with shorter expiration periods experience faster time decay, influencing risk-reward ratios. Traders must consider the impact of time decay when assessing potential risks and rewards of options positions.

3. Market Trends and Volatility:

Market trends and volatility levels significantly impact risk-reward ratios. Bullish or bearish market conditions may favor specific options strategies, influencing risk exposure and potential returns. Traders should adapt their risk management approaches based on evolving market trends and volatility to optimize risk-reward ratios.

Tips for Improving Risk-Reward Ratios

Improving risk-reward ratios is crucial for successful options trading. Here are some actionable tips that traders can use to enhance their risk-reward management:

1. Setting Realistic Profit Targets and Stop-Loss Levels:

One way to improve risk-reward ratios is by setting realistic profit targets and stop-loss levels for each trade. Profit targets define the desired level of profit, while stop-loss levels establish the maximum acceptable loss. By adhering to predetermined exit points, traders can control risk and avoid emotional decision-making during volatile market conditions.

Example: If a trader aims for a 1:2 risk-reward ratio, they might set a profit target of Rs. 200 with a corresponding stop-loss level of Rs. 100 for a given options trade.

2. Using Options Strategies that Align with Risk Tolerance:

Choosing options strategies that align with individual risk tolerance is essential for optimizing risk-reward ratios. Conservative traders may prefer strategies with limited risk exposure, such as covered calls or vertical spreads, while more aggressive traders might explore strategies like straddles or iron condors.

Example: A risk-averse trader might focus on selling covered calls to generate income with limited downside risk, while a risk-tolerant trader may engage in directional strategies like buying long calls or puts to capitalize on market movements.

In conclusion, understanding and effectively managing risk-reward ratios are critical skills for achieving success in options trading.

By implementing the tips outlined above, traders can enhance their risk-reward management strategies and improve overall profitability:

Set Realistic Profit Targets and Stop-Loss Levels:

Establish clear profit goals and risk limits for each trade to optimize risk-reward ratios.

Align Options Strategies with Risk Tolerance:

Choose strategies that match individual risk preferences and market conditions to balance risk and reward effectively.

It’s important to prioritize risk management and continuous learning throughout your trading journey. By staying disciplined, adapting to changing market dynamics, and refining risk-reward strategies, traders can navigate the complexities of options trading with confidence and achieve consistent long-term success. Remember, managing risk is key to preserving capital and maximizing returns in the world of options trading.