In the trading world, patterns help us understand how prices might move. The Head and Shoulders pattern is one of the most popular and reliable chart pattern. In the head and shoulders pattern, there are three peaks. The middle peak is considered the head and the remaining two are the shoulders.

This pattern helps traders spot potential trend reversals. When it forms below resistance or above support then its win rate is better. Whether you’re a beginner or an experienced trader, knowing how to identify and trade this pattern can be very helpful.

This chart pattern is common in all time frames, so every type of trader can trade it. In this blog post, we will understand the head and shoulders pattern in-depth and how it helps traders to win trading battle.

Table of Contents

Toggle1. What is a Head and Shoulders Pattern?

The Head and Shoulders pattern is a trend reversal pattern. This means that when you see this pattern, it suggests that the current trend (whether up or down) is likely to reverse.

There are two types of Head and Shoulders patterns:

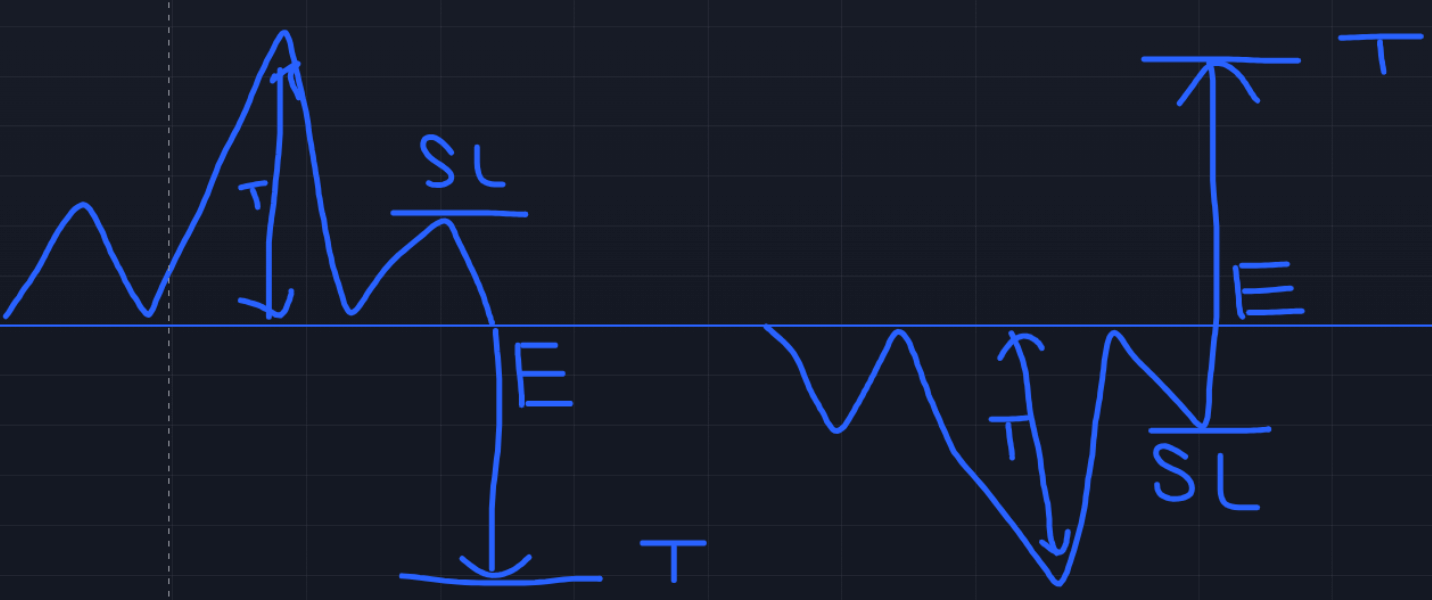

Regular (or Top) Head and Shoulders: This signals that an upward trend will reverse and start going down.

Inverse (or Bottom) Head and Shoulders: This signals that a downward trend will reverse and start going up.

Let’s understand the structure of the pattern.

2. The Structure of the Head and Shoulders Pattern

Imagine a price line on your trading chart that moves like a wave. The Head and Shoulders pattern looks like three peaks (or troughs if it’s inverse) and resembles the shape of a head between two shoulders.

Here’s how it looks:

Left Shoulder: The price first rises to a peak and then falls.

Head: After the left shoulder, the price rises again, but this time to a higher peak, and then falls.

Right Shoulder: The price rises once more, but this peak is lower than the head, forming the second shoulder.

Neckline: The line that connects the lowest points of the two dips between the left shoulder, head, and right shoulder.

For the Inverse Head and Shoulders, it’s the opposite: the pattern forms three low points instead of peaks, and this signals a trend going from downward to upward.

3. How to Identify the Head and Shoulders Pattern?

To identify the pattern, you need to observe your trading chart carefully. Follow these steps to identify the pattern:

- Look for a trend: Before the pattern forms, there should be a noticeable trend. If the price is moving up, you’re likely looking for a regular Head and Shoulders pattern. If the price is moving down, you’re likely looking for an inverse Head and Shoulders pattern.

- Spot the Left Shoulder: The price reaches a high point and falls.

- Spot the Head: The price reaches a higher point than the left shoulder and then falls again.

- Spot the Right Shoulder: The price reaches a peak lower than the head and falls again.

- Draw the Neckline: Connect the lows of the dips between the shoulders and the head with a straight line.

When all these points line up, you have successfully identified the pattern.

4. How to Trade the Head and Shoulders Pattern?

Once you have identified the pattern, the next step is to trade it. Here’s how you can do that:

Step-by-Step Guide to Trading the Head and Shoulders Pattern:

- Wait for the Pattern to Complete: Do not enter a trade too early. Wait for the pattern to fully form. The pattern is only complete when the price breaks below the neckline (in a regular pattern) or breaks above the neckline (in an inverse pattern).

- Confirm the Breakout: After the price breaks the neckline, it’s important to confirm the breakout. Some traders make the mistake of entering the trade immediately after the breakout, but it’s better to wait for a retest of the neckline. Sometimes, the price returns to the neckline after breaking it before continuing the new trend.

- Set Entry Point:

In a regular Head and Shoulders pattern (bearish trend reversal), you enter a sell position when the price breaks below the neckline.

In an inverse Head and Shoulders pattern (bullish trend reversal), you enter a buy position when the price breaks above the neckline.

- Set Stop Loss: Risk management is essential in trading. A stop loss protects you from losing too much money if the trade goes against you.

For a regular pattern, place your stoploss just above the right shoulder.

For an inverse pattern, place your stop loss just below the right shoulder.

- Set Take Profit Target: To estimate how far the price might move, measure the distance between the head and the neckline. This distance is often how far the price is likely to move after the breakout. Use this to set your take profit level.

Sometimes in between entry and target, there is strong resistance. Consider those while taking the trade.

You may like to read: How to Trade Cup and Handle Pattern on Trading Chart

5. Risk Management When Trading the Head and Shoulders Pattern

Risk management is critical in trading, and this pattern is no different. Here are some important risk management tips:

- Always Use a Stop-loss: Markets can be unpredictable. Setting a stop loss ensures that you don’t lose too much if the market moves against you.

- Wait for Confirmation: As mentioned earlier, don’t rush into the trade. Waiting for the price to break the neckline and then retesting it can prevent you from entering a false breakout.

- Don’t Risk More Than You Can Afford to Lose: A common rule in trading is to only risk 12% of your trading capital on a single trade. This way, even if the trade goes against you, you can recover with future trades.

- Be Aware of Market Conditions: The Head and Shoulders pattern works best in trending markets. If the market is choppy (prices going sideways without a clear direction), this pattern might not be reliable.

6. 12 Important Rules to Trade Head and Shoulders Pattern successfully

1) Mark swings and necklines in the live market to identify head and shoulders pattern easily.

2) Wait for the proper formation of the pattern don’t rush.

3) Risk reward ratio must be more than 1:2 minimum compulsory.

4)Take entry only after the breakout or breakdown of the neckline.

5) If closing is away from the neckline then wait for retesting otherwise avoid entry.

6) The first target must be the depth of the head.

7) Stoploss must be the height of the shoulder.

8) If the price reverses from 70-80% of your target or shows any opposite sign then stop loss must be on cost.

9) If the price is stuck for more than 45-60 minutes then exit the trade at market price. This is known as the 45-60 rule.

10) Never take a trade to look for profit only also look for risk.

11) Before taking trade always look for obstacles before target.

12) When the market shows any opposite sign or pattern at the same time of head and shoulder avoid the trade.

7. Common Mistakes to Avoid

Even though the Head and Shoulders pattern is reliable, traders often make mistakes. Here are a few to watch out for:

- Entering the Trade Too Early: Don’t jump in as soon as you think you see the pattern. Wait for the neckline to break.

- Ignoring the Retest: After the neckline breaks, sometimes the price comes back to retest the neckline. Ignoring this can lead to entering the trade at the wrong time.

- Not Using a Stop-loss: Always protect your capital by using a stoploss.

- Trading in the Wrong Market Conditions: This pattern works best in trending markets, so avoid using it when the market is moving sideways.

Conclusion

The Head and Shoulders pattern is one of the most well-known and trusted patterns in trading. It helps traders spot potential trend reversals, making it a powerful tool in your trading toolkit. However, like all trading strategies, it’s important to use it with proper risk management and not rely on it blindly. If traders combine it with proper chart reading then it is more effective.

By patiently waiting for the pattern to fully form, confirming the breakout, and using stop losses and take profit targets, you can trade this pattern effectively and minimize risk. Happy trading!