Options Day Trading Journal And Its Role In Profitable Trading

26/08/2025

Day Trading Journal An options day trading journal is the most important and useful tool while doing trading. It is...

Read more

How to Learn Trading in Stock Market for Beginners

29/08/2024

Imagine this – Every year millions of people worldwide start investing in the stock market. For example, over 10 million...

Read more

Know the Basics of Trading in Stock Market

09/08/2024

Basics of Trading in Stock Market A stock market is where people buy and sell shares of companies. Think of...

Read more

Learn Trading in Stock Market – Tips & Techniques

01/08/2024

Learn Trading in Stock Market Imagine having the power to make money with just a few clicks of buttons on...

Read more

Understanding the Role of Liquidity in Trading

25/07/2024

Understanding the Role of Liquidity in Trading Imagine you are in a crowded market, eager to buy some fresh produce....

Read more

Role of Position Sizing in Options Trading Profitability

27/04/2024

Role of Position Sizing in Profitable Options Trading Options trading involves buying and selling contracts that give you the right...

Read more

What is The 90 90 90 Trading Rule in Options Trading?

19/04/2024

90 90 90 Trading Rule in Options Trading When we talk about the 90 90 90 trading rule, we’re referring...

Read more

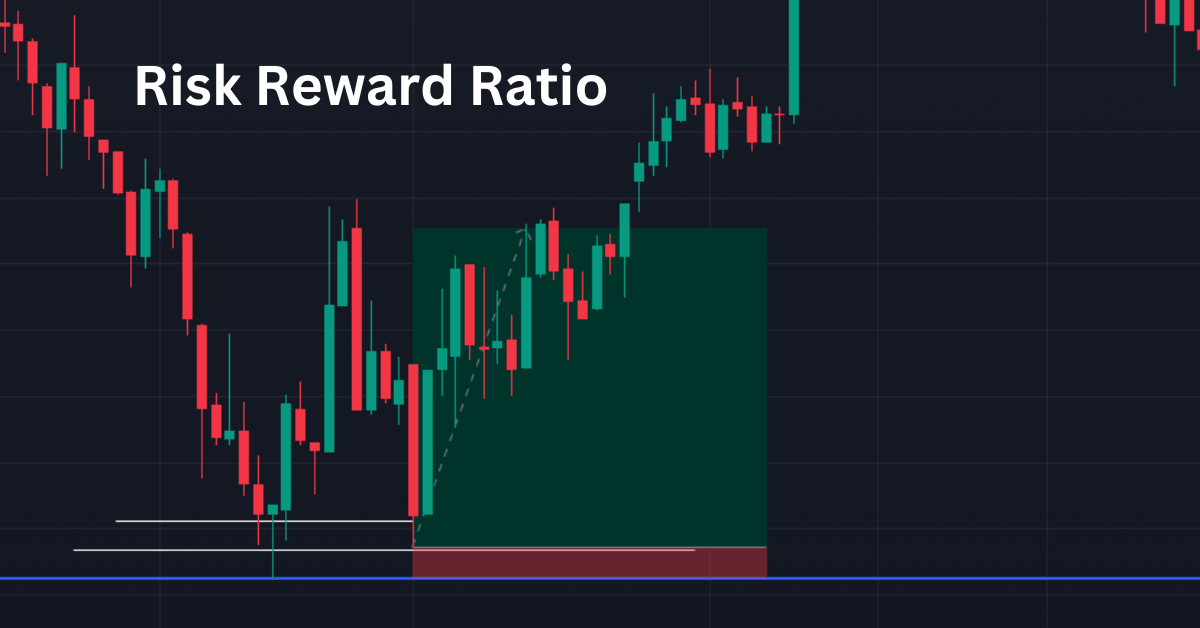

Mastering Risk Reward Ratio For Profitable Options Trading

06/04/2024

Mastering Risk Reward Ratio For Profitable Options Trading In options trading, the risk-reward ratio is a fundamental concept that assesses...

Read more

The Importance of Risk Management in Options Trading

04/04/2024

Importance of Risk Management in Options Trading Risk management is important in options trading as it helps traders protect their...

Read more

How Stop Loss Trailing Helps Ride Profits in Options Trading?

03/04/2024

Learn how stop loss trailing optimizes profits in options trading. Master the technique to ride gains and minimize losses effectively.

Read more