Options trading involves buying and selling contracts that give you the right to buy or sell shares at a certain price in the future. It’s like making bets on where the shares prices will go.

Position sizing is really important in trading because it’s about how much money you put into each trade. It can make a big difference in how much money you make or lose.

Position sizing means deciding how much money to invest in each trade based on factors like risk and account size.

In this blog post, we’ll talk about why position sizing in options trading matters so much and explore different strategies to help you make smarter decisions.

Table of Contents

ToggleUnderstanding Position Sizing in Options Trading:

I. Definition and significance:

Position sizing in options trading is all about deciding how much money to put into each trade. It’s super important because it helps you manage risk and maximize profits. Basically, it’s like deciding how big or small your bets should be when trading.

II. Different approaches to position sizing:

1. Fixed amount:

This means you invest the same amount of money in every trade, no matter what. It’s simple and easy to understand.

2. Percentage of portfolio:

With this approach, you invest a certain percentage of your total account balance in each trade. So, if your account grows, your trade sizes grow too.

3. Risk-based position sizing:

This method looks at how much you could lose on a trade and adjusts your position size based on that. It’s all about controlling your risk and making sure you don’t lose too much on any single trade.

III. Pros and cons of each approach:

1. Fixed amount:

- Pros are simplicity and consistency.

- The cons are that it doesn’t account for changes in account size or risk.

2. Percentage of portfolio:

- Pros are that it adjusts to your account size and helps with risk management.

- The cons are that it can lead to bigger losses if your account shrinks.

3. Risk-based position sizing:

- Pros are that it helps control risk and can prevent big losses.

- The cons are that it can be more complicated to calculate and implement.

These different approaches have their own benefits and drawbacks, so it’s important to choose the one that works best for you and your trading style.

Factors Influencing Position Sizing:

I. Risk tolerance and risk management:

This is all about how much risk you’re comfortable taking. If you’re okay with taking bigger risks, you might invest more in each trade. But if you’re more cautious, you’ll want to invest less to protect yourself from big losses.

II. Volatility of the underlying asset:

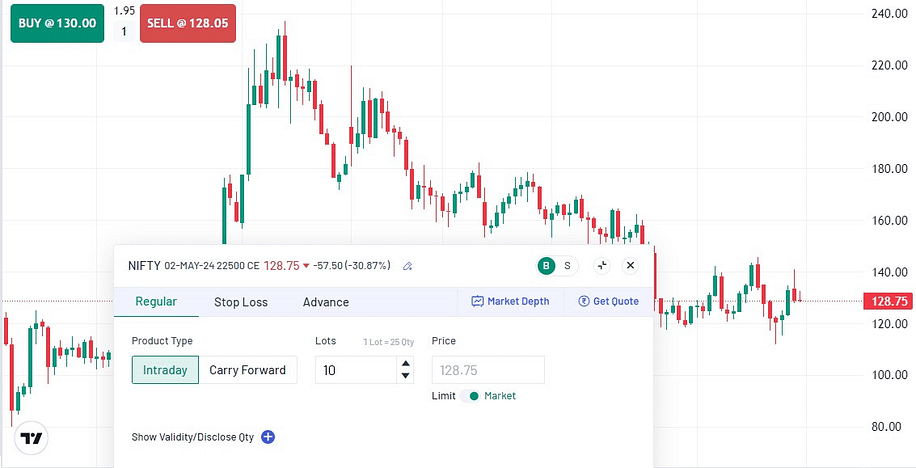

Volatility means how much the price of the stock or asset goes up and down. If something is really volatile, it can be riskier, so you might invest less. But if it’s not very volatile, you might feel safer investing more. We can take here example of Nifty-50 and Bank Nifty, Bank Nifty more volatile than Nifty-50. So, it is an advice from professional to novice, that in beginning work in Nifty -50 only to reduce risk of loss.

III. Trading strategy and timeframe:

Different strategies and timeframes can affect how much you should invest. Some strategies might need bigger bets to work well, while others might need smaller ones. And if you’re planning to hold onto a trade for a long time, you might want to invest differently than if you’re only holding it for a short while.

IV. Account size and capital allocation:

This is about how much money you have to invest overall and how much of that you want to put into each trade. If you have a bigger account, you might be able to invest more in each trade. But if your account is smaller, you’ll need to be more careful with how much you invest.

V. Impact of leverage on position sizing decisions:

Leverage means using borrowed money to invest. It can magnify your gains, but it can also increase your losses. So, if you’re using leverage, you might need to invest less to manage your risk.

All these factors play a role in deciding how much money to put into each trade. It’s important to think about them carefully to make smart decisions and protect your money.

Position Sizing Strategies for Options Trading:

I. Delta-adjusted position sizing:

Delta is a measure that tells you how much an option’s price will change for every Rs 1 change in the price of the underlying asset. With delta-adjusted position sizing, you adjust how much you invest based on the delta of the options you’re trading. If an option has a higher delta, you might invest more because it’s more sensitive to price changes.

II. Kelly Criterion and its application in options trading:

The Kelly Criterion is a formula used to calculate how much of your bankroll you should invest in each trade to maximize long-term growth. It takes into account your win rate and the size of your wins and losses. In options trading, you can use the Kelly Criterion to help determine the optimal position size for each trade.

III. Using implied volatility to determine position size:

Implied volatility is a measure of how much the market expects the price of an asset to change in the future. Higher implied volatility means options are more expensive, so you might invest less to manage risk. Lower implied volatility means options are cheaper, so you might invest more.

IV. Adjusting position size based on market conditions and trade setup:

Market conditions and trade setups can change over time, so it’s important to adjust your position size accordingly. If the market is volatile or if you’re trading a riskier strategy, you might invest less. If the market is calm or if you have a strong trade setup, you might invest more.

These strategies help you manage risk and maximize returns when trading options. It’s important to understand each one and choose the ones that work best for you and your trading style.

Risk Management Techniques:

I. Setting stop-loss orders and profit targets:

Stop-loss orders are like safety nets for your trades. You set a price at which you’re willing to sell if the trade goes against you, limiting your potential losses. Profit targets are the opposite – they’re prices at which you decide to take profits, locking in gains. Both help you control risk and stick to your trading plan.

II. Portfolio diversification and correlation analysis:

Portfolio diversification means spreading your investments across different assets to reduce the impact of any single investment’s performance. Correlation analysis helps you understand how different assets move in relation to each other. By diversifying your portfolio and considering correlations, you can reduce overall risk and improve stability.

III. Importance of maintaining trading discipline:

Trading discipline means sticking to your trading plan, even when emotions are running high. It involves following your rules for position sizing, risk management, and trade execution, without letting fear or greed cloud your judgment. Maintaining discipline helps you avoid impulsive decisions that can lead to losses and ensures consistency in your trading approach.

Position Sizing Tools and Resources:

I. Overview of available position sizing calculators and software:

Position sizing calculators and software help you determine the optimal size for your trades based on factors like risk tolerance, account size, and market conditions.

These tools often provide customizable settings and real-time data analysis to assist you in making informed position-sizing decisions. Examples include online calculators, trading platforms with built-in position sizing features, and standalone software applications.

II. Tips for building custom position sizing models:

Building custom position sizing models allows you to tailor your approach to match your trading style and preferences. Start by defining your risk parameters and objectives, then design a model that incorporates factors like account size, volatility, and trade setup criteria.

Test your model thoroughly with historical data to ensure its effectiveness before implementing it in live trading. Additionally, consider incorporating feedback and adjustments based on real-time performance to continuously improve your position sizing strategy.

III. Recommended books, courses, and online resources for further learning:

To deepen your understanding of position sizing in options trading and enhance your trading skills, consider exploring educational resources such as books, courses, and online platforms. Look for reputable sources authored by experienced traders or financial experts that cover topics like risk management, portfolio optimization, and advanced position sizing techniques.

Read More: How to Become A Profitable Day Options Trader?

Psychological Aspect of Position Sizing:

I. Overcoming emotional biases in position sizing decisions:

Emotions like fear and greed can often cloud our judgment when it comes to deciding how much money to put into each trade. Overcoming these biases means being aware of them and making decisions based on logic and strategy rather than emotions. It’s about staying calm and sticking to your plan, even when emotions are running high.

II. Dealing with fear and greed in trading:

Fear can make us hesitant to take risks, leading us to invest less than we should. Greed, on the other hand, can make us take bigger risks than we should, hoping for larger profits. Dealing with fear and greed involves recognizing when these emotions are influencing our decisions and taking steps to mitigate their impact. This might include setting strict rules for position sizing and sticking to them, regardless of how we’re feeling.

III. Developing a mindset for disciplined position sizing in Options Trading:

Discipline is key to successful position sizing in options trading. It means following your plan consistently, even when it’s tempting to deviate from it. Developing a disciplined mindset involves practicing self-control, patience, and resilience.

In conclusion, It’s about staying focused on your long-term goals and not letting short-term emotions derail your strategy. With discipline, you can make more rational and informed position-sizing decisions, leading to better trading outcomes.

Position sizing in options trading plays a crucial role in options trading as it determines how much money you invest in each trade, impacting both risk and potential returns. It helps manage risk, maximize profits, and maintain consistency in trading.

Optimizing position sizing in options trading strategies involves considering factors like risk tolerance, market conditions, and trading objectives. By using tools and techniques such as delta-adjusted sizing, risk-based approaches, and disciplined execution, traders can enhance their overall trading performance.

It’s essential for traders to prioritize position sizing in their trading plans to achieve long-term success. By focusing on proper risk management and disciplined position sizing, traders can mitigate losses and improve the consistency of their trading results.

Feedback and discussion are valuable for continuous learning and improvement. Traders are encouraged to share their experiences, strategies, and insights on position sizing in options trading to foster a supportive and collaborative trading community. Your feedback and contributions are welcomed and appreciated. Let’s keep the conversation going!